Part 3 – Choose the right ideas to back

A deep dive into the essential innovation practices of choosing the right ideas for your innovation portfolio.

Written by

April 15, 2021

We are now at part 3 of our article series on the 8 innovation essentials, a collection of attributes and behaviours that underpin superior innovation performance. In the last articles we highlighted why it is not enough to just have sky high aspirations. Executives need to tie innovation to the overall strategy, set concrete targets and allocate resources to support the best innovation opportunities. However, how can we ensure that we choose the right projects that help us execute our aspiration and how can we use our time, budget and resources most efficiently? In part 3 we will take a closer look at those questions as we deep dive into the innovation essential “Choose” – prioritising and selecting innovation opportunities.

*If you haven’t read part 2 yet, we highly recommend reading it before continuing.

As a starting point it is important to understand the link between “Aspiration” and “Choose”. If your ideas and projects in the portfolio are not tied to your aspiration and overall strategy it is virtually impossible to allocate resources in a meaningful way. Since nobody can foresee the future, we need a better strategy than luck to choose the opportunities that can help us achieve our targets. Instead, we need to set up a process and nurture a culture that constantly feeds the portfolio with ideas distributed across our goals and allocate resources for testing and incubation to the ones with the biggest potential.

In the following we will provide you with actionable advice on (1) how to create a time-risk balanced innovation portfolio and (2) how to raise the probability of backing the right ideas with sufficient resources.

How do you create a time-risk balanced portfolio?

Companies can’t neither solely rely on innovation efforts aimed at the core nor on the other extreme, self disruption. In order to succeed both in the short and long term a risk and time balanced portfolio that aligns with your aspiration is indispensable. We recommend categorising the projects into time to ROI. We like to use the 3-horizon model . Horizon 1 describes ideas at the core with an ROI within a year. Horizon 2 encompasses emerging opportunities likely to create a profit in the future and Horizon 3 includes ideas that could contribute to profitable growth within a time frame +3 years down the line. A balanced portfolio should have ideas on all 3 horizons from “easy win’s” to “wild shots or big bets”.

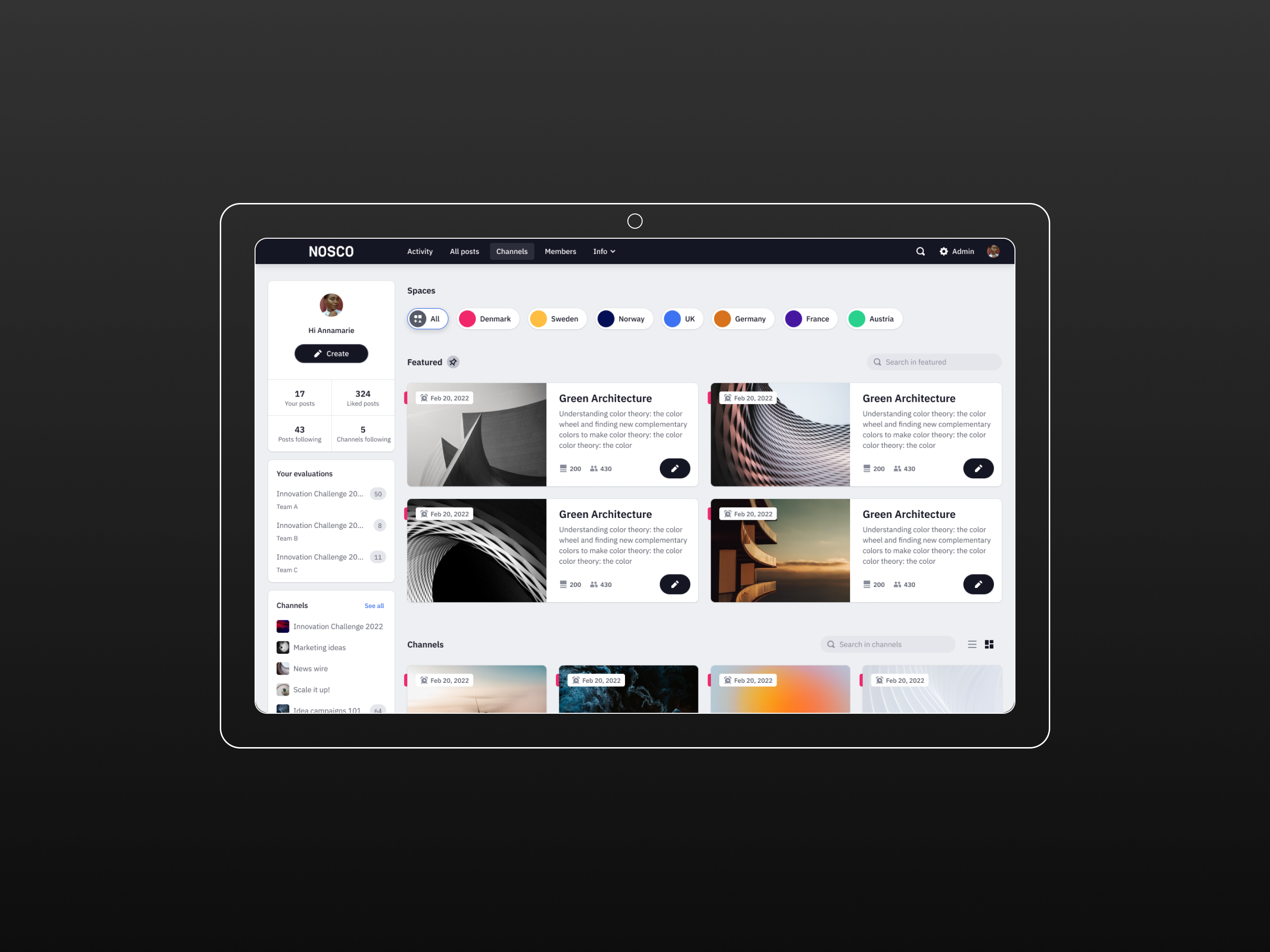

The foundation of your portfolio is a strong infrastructure and commitment. The infrastructure ensures a transparent process to source new ideas, identify search fields and choose the right ideas to incubate. While commitment pushes executives to start building the pipeline and allocating resources needed for incubation. In our experience using a digital platform combined with the idea campaign methodology works well in achieving both.

The digital innovation platform allows you to source a large and diverse pool of new ideas across all corners of the organisation, involve different stakeholders in the selection and structure ideas into opportunity spaces. The idea campaign approach establishes a quick and transparent process from idea to investment decision within your search fields. Within a short period of time you will have 15-25 ideas that can be mapped along the 3 horizons. Critical stakeholders and resource owners are involved in the selection process creating the commitment to execute. Based on your strategy and portfolio gaps, 5-7 high potential ideas are then chosen to move to a three-month incubation. Thus, reducing the critical investment decision to yes or no to give a small team a moderate budget to test and validate the idea quickly.

Keep in mind that an infrastructure is not built in one go but as you go. It is all about getting it going. Execution beats finding the ideal structure. Rather learn by experience and iterate, than wait until the ideal model is found (it never will!).

To sum it up:

– Start forming the infrastructure

– Identify opportunity spaces or “search fields”

– Creating a large pool of ideas to choose from

– Involve the resource owners in the screening and selection process

How do we raise the probability of backing the right ideas, with sufficient resources?

We believe that the future success of ideas is closely connected to the way it was dealt at the start. Traditionally, idea authors are asked to present a business case already at an early stage. The problem is that often the case is built on a lot of hope, assumptions and sometimes is even inflated so it looks more attractive. The idea author knows that executives want to “see the money”, so they give them what they want. That is why we have created an alternative method for gradually maturing ideas into a business. Killing the idea of the “business case” in the early stages and instead asking executives to invest in learning cycles and validation.

In the new practice, the idea team presents their main assumptions and hypothesis, and only asks for resources to validate or debunk them, one step at the time. The first steps are cheap. Let us find and talk to 10 customers and see what they are saying. Then, if we gain confidence, and trust our insights, we can move on to create more elaborate prototypes for further testing. Once we are convinced about the ideas potential, we can finally move on to larger scale experiments.

Boiled down, we need to find convincing evidence to the following questions:

– Is there a real need behind?

– Would anyone desire this?

– Would they buy it?

– Can we build it?

– And can we, down the line, earn money on this?

Every month or quarter, executives will be presented with the learnings, and based on them make decisions to either kill or further pursue the idea. Together with a good time-risk portfolio overview, executives can make better decisions in which search areas they need to invest more.

The key questions executive boards need to ask is: Are we playing offence or defence? Do we have enough knowledge about emerging and foreseeable trends that can destabilise our business? Do we have someone who is working on those emerging and foreseeable ideas? What stage are the ideas in and how much time and resources do they need before we can take them to market?

Morten has more than 20 years of experience as a management consultant, helping Implement Consulting Group grow to the largest independent consultancy in Scandinavia. An entrepreneur at heart, he has started and grown several successful businesses and now serves as a board member to numerous start-ups.

MORE ARTICLES